It’s been a year marked by sharp movements and shifting dynamics in the commodity markets, and through it all, ADM Agriculture has remained committed to helping you make informed decisions for your business. To wrap up the year, our trading team shares their reflections on 2025 and their outlook as we head into 2026.

WHEAT

Wheat markets in 2025 were dominated by sharply weaker global prices as major exporters accumulated larger stocks, exerting sustained downward pressure. The year opened with winter freeze concerns across the Northern Hemisphere, supporting prices through January, but sentiment quickly shifted when U.S. President Trump’s second-term administration re-took control and began conversations around broad trade tariffs in February. These policies were widely interpreted as negative for global trade flows and demand, setting the tone for a bearish year. Market volatility persisted as ongoing speculation around tariffs frequently clashed with emerging realities, deepening the downtrend. Geopolitical tensions—including the continued Russia-Ukraine conflict and war in the Middle East—periodically injected risk premium into grain and broader macro markets. However, rallies repeatedly faltered as comfortable global balance sheets overshadowed these disruptions. Record U.S. corn yields and swelling ending stocks added further pressure, while Russia’s re-established dominance as a major wheat exporter intensified competition across the feed-grain complex. In the second half of the year, expectations for exceptionally large Southern Hemisphere wheat crops, particularly in Argentina and Australia, delivered another bearish blow. Global ending stocks are now projected to rise year on year. Europe, despite smaller 2024/25 crops and reduced ending stocks, was unable to escape the global trend. Production ultimately met expectations, with the region harvesting around 20% more wheat, but exports lagged due to fierce competition—especially from Russia—keeping European prices on the defensive. In the UK, the market was shaped by persistent price weakness, a late capitulation from old-crop holders, and a disappointing new-crop harvest after a record dry spring and early summer dragged on yields. Strong quality performance reduced the need for imported premium wheat, but domestic liquidity remained thin. Many growers continue to face negative margins, as current market prices fail to cover production costs heading into the new year.

BARLEY

2025 played out to be a much tighter picture for UK barley. Production was down to around 6.4Mmt, a sharp drop from 2024, as growers pulled back on barley acreage and spring barley yields disappointed following a challenging growing season. Even with larger than normal opening stocks factored in, total availability for the 2025/26 season is still approximately 10% below average. We have also seen a continued demand shift over the course of 2025. Use of barley by the malting and brewing industry, historically a key market, has fallen off a cliff at approx. 9% below average. As a result, malting premiums have weakened to just above feed, or even below in some areas. With barley prices proving competitive vs other cereals, alongside lower forage availability, the feed industry has absorbed additional barley volumes and supported prices, despite the UK being uncompetitive for export, for most of the season.

OILSEED

The UK rapeseed market has spent much of the year navigating between improving global crop prospects and an almost constant backdrop of geopolitical volatility. Tariff headlines from the US, China, Canada and Mexico repeatedly drove sharp swings in oilseed markets. Fluctuating crude oil prices—caught between OPEC+ output changes, Red Sea tensions and shifting Russian supply expectations—kept oilseed crusher margins closely tied to wider energy sentiment. European crops generally developed well, easing supply concerns, while UK growers saw the best yield in years. Periodic rallies emerged when crush margins allowed or geopolitical risk flared, but improving soybean and canola yield expectations, combined with sluggish Chinese demand, frequently weighed on attempts to sustain any uptrend into Harvest year 25.

Looking ahead to the new year, the key watchpoints remain familiar: US tariff policy, particularly the prospect of further blanket measures, continues to pose significant trade flow uncertainty; crude oil volatility will keep the vegetable oil complex on edge; and Northern Hemisphere weather will, as always, quickly take centre stage once spring planting begins. EU supply looks comfortable and crop conditions across Europe look positive, but Canada’s 2025 outlook and Chinese import appetite will determine whether rapeseed can build meaningful upside. For UK growers, currency and crush demand will remain pivotal drivers, with any shift in biofuel policy or geopolitical stability capable of quickly reshaping sentiment.

OATS

The UK oat market entered 2025 with stocks from the 2024/25 harvest, which is widely regarded as the highest quality in recent memory, with nearly all samples meeting human consumption grade. Millers reported exceptional extraction rates and improved millability characteristics.

The remarkable quality of the 2024/25 harvest came as a surprise, given the challenging weather conditions, including a very wet autumn and delayed spring planting. Many spring crops were not sown until late April or early May, well past the optimal planting window in February. As a result, there were concerns that screening levels and specific weights would be subpar and yields would be lower than expected. However, due to favourable growing conditions from May through to harvest, many growers reported record yields, with specific weights typically exceeding 56kg/hl. This surge in production led to a significant surplus of high-quality milling oats carried over into the 2025/26 marketing season. Coupled with a 13% increase in planted oat area for the 2025 harvest, this surplus has contributed to a consistent decline in prices.

Domestic and European demand for UK oats has also been lacklustre, largely due to large yields in Spain, along with ample supplies in Sweden, Finland, and Germany. In the UK, consumers have benefited from reduced hulling losses in the 2024/25 crop, meaning fewer tonnes were required to meet the demand for finished oat products.

Looking ahead to the 2025/26 marketing season, UK growers are facing challenges due to weak export demand and limited domestic buyers. As a result, it has been difficult to prevent a further decline in milling oat prices.

However, the market may see a recovery next year, as many UK growers are expected to switch some of their oat acreage to wheat. This could lead to a significant reduction in planted oat area, and if quality is variable, this could trigger a price increase due to lower supplies.

BEANS

The 2025 harvest was remarkable across most commodities, and beans were no exception. An exceptionally dry end to the growing season sped up ripening and pushed harvest dates to record-early levels. Some winter beans in East Anglia were cut as early as 4 July after heat and drought caused the crop to die off. As expected, yields were highly variable, ranging from under 2mt/ha to over 6mt/ha, with a national average of around 3mt/ha.

Beans opened the season with a firm premium over ICE London feed wheat futures, closely mirroring the start of 2024. As the season progressed, confidence grew in the crop’s resilience despite a year-on-year reduction in planted area. Prices eased, but were supported by expectations of lower production. Even so, beans failed to fall enough to stay competitive against alternative feed ingredients such as rapeseed meal and DDGs. This created a more balanced UK supply-and-demand picture and pushed the market to look for its usual export outlets in North Africa. However, strong local stocks and the pressure of a growing Australian new crop—now being harvested—kept export interest muted.

Overall, beans have faced a challenging season, squeezed by ample global supply and cheaper feed alternatives. Prices are expected to remain subdued, with a neutral to slightly bearish outlook.

PEAS

The 2025 season has been one of mixed fortunes for the pea market, shaped by weak demand, heavy global supplies, and shifting trade dynamics. Prices remained under pressure for most of the year, with little sign of recovery as buyers and sellers struggled to find common ground.

Globally, the biggest developments came record high stock in Canada and when India imposed a 30% import tariff on yellow peas. This policy change removed a major outlet for Canadian exports and sent ripples through international markets. Exporters were forced to redirect tonnage elsewhere, adding to already high stock levels and intensifying downward pressure on prices. Despite speculation that the tariff might be temporary, it now appears likely to stay in place well into 2026.

In the UK, the 2025 pea harvest delivered variable results. Early crops showed good colour and reasonable yields, but frequent rain and a late-season heatwave caused bleaching and stress in later fields. Quality has been uneven, and soaking performance issues have been noted in some samples. Overall, yields were broadly in line with expectations given the weather, though not exceptional. Whilst across Europe, crops generally performed better than forecast, adding further supply to a market already struggling with slow consumer off-take. Demand for both feed and human consumption peas remained subdued throughout the year, with buyers adopting a cautious, short-covering approach.

Old crop business dried up early, and new crop prices have traded mostly sideways since. Farmer selling has been limited, while buyers continue to purchase only as needed.

In summary, 2025 was a year of oversupply, muted demand, and policy-driven disruption. Without a shift in trade flows or a meaningful lift in consumption, the pea market is likely to remain under pressure as we move into the new season.

Looking ahead, 2026 buyback contracts are almost fully booked, reflecting strong early interest despite current market challenges. Growers yet to secure an area are advised to act quickly.

2026/27 AHDB Recommended List: What Growers Need to Know

ADM Agriculture – Winter Wheat, Winter Barley & OSR Update

The new 2026/27 AHDB Recommended List (RL) has now been released, bringing some of the most significant changes in recent years. With major disease rating recalculations, standout new additions and several long-established varieties removed, many growers will be assessing their cereal strategy for the year ahead. Below is an overview of what has changed, what it means, and the key varieties ADM will be focusing on this season.

A More Selective Recommended List

This year’s RL is noticeably streamlined. AHDB has added fewer varieties and removed more, resulting in:

- 8 new winter wheats added

- 11 winter wheats removed

- 3 new winter barleys added

- 8 winter barleys removed

- 7 new OSRs added

- 9 OSRs removed

WINTER WHEAT

The biggest change comes from the recalculation of yellow rust ratings following the emergence of a new rust strain capable of overcoming the once-reliable Yr15 resistance gene. Because of this, yellow rust scores have been recalculated using only 2025 harvest data, giving growers a much clearer and more relevant picture of current disease pressure.

As the saying goes, you wait for a bus and three come at once, we welcome a new Group 1 for the third year running, this time with Arlington (currently a provisional Group 1 UKFM variety). Agronomically strong, Arlington takes many characteristics from its parent Skyfall, including drilling flexibility and Orange Wheat Blossom Midge resistance. However, due to very limited seed availability this autumn, its first major commercial year will be for 2027 drilling.

Among the new feed wheat additions, several stand out options strengthen ADM’s portfolio. For growers pushing treated yield as far as possible, KWS Aintree is the barn-filler of choice, delivering exceptional yield potential, though it requires close monitoring for yellow rust. For those needing a dependable, versatile option that performs even when spray timings slip, LG Defiance offers strong treated and untreated performance (the highest untreated yields on the new RL). Defiance is proving particularly effective as a second wheat, though its taller straw means it pairs best with a well structured PGR programme.

Where early maturity is a priority, KWS Fowlmere is the earliest maturing wheat on the RL and combines that earliness with high yield potential.

The new group 4 soft wheat, Sparkler, provides an excellent mix of high yield potential and strong Septoria tritici resistance, making it an attractive offering going forward.

These newcomers slot neatly into ADM’s broader wheat portfolio and complement established performers such as KWS Vibe (expected to gain further traction in its second year), farm favourite soft wheat Bamford, KWS Scope, and others—ensuring we have varieties to suit every drilling window, rotation, and management approach.

WINTER BARLEY

One of the standout developments from this year’s Recommended List is LG Capitol. Although now in its third year on the market, its performance continues to impress—its consistency and reliability have secured its position at the very top of the list for growers prioritising strong, dependable feed yields. Hybrid barley also remains an excellent option where blackgrass or marginal land present challenges; the added vigour, biomass and canopy competitiveness make varieties such as Inys and Quantock well suited to these more demanding situations. Meanwhile, Craft continues to hold its place as the leading choice within the winter malting sector.

As growers increasingly prioritise yield, disease security, drilling flexibility and premium earning potential, ADM’s cereal portfolio is structured to offer distinct strengths that match real world farm situations rather than a one-size-fits-all approach.

OILSEED RAPE

A standout newcomer to the OSR RL this year is Karat, a high yielding hybrid that brings one of the strongest all round agronomic packages seen. It delivers a powerful combination RlmS and Rlm12 stem canker resistance – the first time these Phoma genes have been stacked together, as well as TuYV resistance.

Karat also offers excellent autumn vigour, making it particularly well suited from mid to late drilling, pushing the drilling date back with this variety can help mitigate CSFB pressure. The variety is tall but notably stiff, carries good oil content, and arrives on the RL as the joint highest yielder in the East/West region and the second highest yielding OSR variety for the UK.

For growers seeking high autumn vigour, resilience and consistent performance, Karat is shaping up to be a significant new option for 2026 sowing.

Karat complements ADM’s existing OSR Portfolio, giving growers another robust choice where early vigour, disease security and season long reliability are priorities.

Looking Ahead: Plan Early

Many of this year’s standout new varieties are expected to see strong early demand, with seed likely to sell out quickly. ADM recommends growers plan ahead and discuss rotation fit and availability with their ADM Farm Trader as early as possible to secure preferred options for 2026 drilling.

FERTILISER – Positioning for Spring 2026

Market activity through December has followed a structurally similar pattern to last year. Purchasing has remained lighter, with a high volume of buying once again being pushed into the spring window. Importers are increasingly keen to close monthly books earlier to protect movement commitments and manage forward allocations.

As always, product choice narrows as spring progresses and delivery windows become fully booked, which pushes essential inputs further back into the season. Growers who position now secure both availability and haulage at the correct time, rather than buying against tightening logistics in February and March.

A Snapshot of our Spring Product Availability

- Ammonium Nitrate

- 33.5% AN from LAT

Nitram 34.5% - Sulphur Grades

- 27N 10SO3

27N 12SO3

26N 37SO3 - Blends

- High quality NPK blends

High quality PK blends

Tailored to crop need, soil indices and spreader width - Straights

- DAP

TSP

MOP

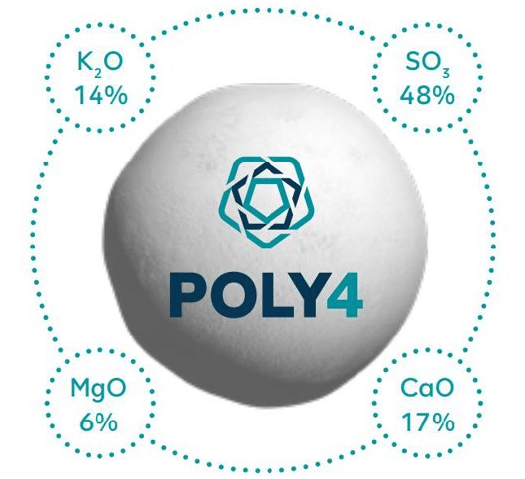

New for 2026 – POLY4

Spreading 36 metres with uniform granules, and can be used as a straight or within blends.

Based on Polyhalite, the product performs strongly on combinable crops, roots, vegetables and grassland. Median trial results across more than seven hundred European field sites show consistent yield improvements, including plus 170 kg per hectare in wheat, plus 230 kg per hectare in barley, plus 1040 kg per hectare in potatoes, and plus 310 kg per hectare in grassland biomass.

It also supports soil structure through its calcium content and is neutral to soil pH, with no evidence of negative impact on soil biology.

Finance Options to Fit your Business

We offer flexible finance arrangements, including deferred payment structures running until after harvest, along with options designed to fit individual business cashflows and cropping cycles. These allow our growers to secure spring nutrition without bringing unnecessary cost forward into that window.

_________________________________________________________________________________

We are incredibly grateful for your support in 2025 and we wish you a Happy Holiday Season from the whole ADM fertiliser team.