2025 AHDB Winter Wheat Harvest Results: Key Insights

With the 2025 AHDB winter wheat harvest results rolling in, it’s time to review how key varieties have performed across the groups so far. This year’s data provides a clear snapshot of yield outcomes amid changing disease pressures—particularly yellow rust—helping growers make more informed seed and management decisions for the coming season.

Group 1 & 2: Encouraging New Options in the Quality Market

Among Group 1 milling wheats, SY Cheer has stood out this year, yielding 3% above its 5-year average—an encouraging result that suggests it is well-adapted to current conditions. Crusoe has also had a strong year, yielding 1% above its typical average, reinforcing its continued relevance in high specification milling markets.

KWS Vibe, Skyfall and KWS Zyatt delivered yields closely in line with their 5-year averages, confirming their consistency and reliability. For many years, growers had limited choice in the Group 1 segment, but the arrival of SY Cheer and KWS Vibe has introduced not only improved yield potential but also notable gains in disease resistance—making them competitive alternatives to older mainstays.

It’s also worth mentioning Arlington, currently a candidate variety from breeder DSV. While its Group 1 status is yet to be confirmed, it brings a unique agronomic package to the table: orange wheat blossom midge (OWBM) resistance and the Pch1 gene for eyespot resistance—a combination we’ve previously only seen in Skyfall.

In Group 2, performance has been slightly more subdued. KWS Arnie saw a modest dip, yielding at 103% compared to a 5-year average of 104%. Extase also came in just 1% below its long-term average.

Group 3 & Soft Group 4s: Stability and Agronomic Strength

In the soft wheat sector, Bamford has performed closely in line with expectations—further reinforcing its reputation for reliable, stable yields. Solitaire is currently tracking 1% above Bamford’s yeilds, making it an attractive choice for growers looking for consistency and additional agronomic benefits.

Both varieties are supported by strong straw strength and robust disease resistance, while Solitaire also brings OWBM resistance, adding extra flexibility.

Among Group 4 soft wheats, Hexton continues to carve out a niche. Yielding at 102% in this year’s trials, it performs especially well on lighter soils and shows particularly strong performance in the North and in a second cereal position. Hexton also stands out for being exceptionally clean, with a very strong disease resistance profile, making it a solid choice for growers prioritising lower input costs and in-field reliability.

Group 4 Hard Wheats: Feed Market Leaders Emerge

In the Group 4 hard feed sector, KWS Dawsum has once again had an excellent season—yielding 2% above its 5-year average. This reinforces its position as a consistent, top-performing feed wheat with strong on-farm support thanks to its proven resilience and high output.

Looking ahead to the 2026 autumn drilling campaign, among the candidate varieties, KWS Aintree currently tops the yield tables. However, it does come with a known susceptibility to yellow rust, which, while manageable with a robust fungicide programme, will require extra attention during the season.

Not far behind is LG Defiance, which offers an impressive combination of high yield potential and broad-spectrum disease resistance. It continues to show excellent untreated yields, highlighting its suitability for lower input systems or situations where fungicide access is limited.

Also worth noting is KWS Fowlmere, which provides growers with a valuable option for spreading the harvest workloadthanks to its very early maturity.

Yellow Rust: A Changing Threat in 2025

One of the biggest takeaways from this year’s results is the increasing pressure and variability from yellow rust. The emergence of new pathogen strains has impacted varietal resistance ratings across the board. Some varieties that previously held strong resistance scores have shown vulnerability in 2025.

This shift underscores the importance of:

- Implementing integrated disease management strategies, including tailored fungicide applications

- Remaining vigilant with season-long monitoring

- Selecting varieties with up-to-date resistance genetics and spreading risk across multiple varieties.

Final Thoughts

The 2025 AHDB winter wheat harvest results offer timely, valuable insight into how varieties are performing under the dual pressures of changing weather patterns and shifting disease dynamics. While several varieties—like Dawsum, Cheer, Crusoe, and Solitaire—have maintained or exceeded expectations, others have shown where attention to localised disease risks and site conditions will be key in 2026. For growers, the message is clear: success lies in balancing yield potential with agronomic strengths, such as disease resistance, straw quality, and pest resilience. Doing so not only protects output but also enhances resilience in increasingly unpredictable season.

Cost Justification – It Doesn’t Take Much

A yield increase of less than 135kg/ha is enough for certified seed to pay for itself. That’s a very achievable threshold when you consider the benefits of:

- Access to new genetics

- Improved germination and establishment

- Reduced risk of seed-borne disease

- Better overall crop vigour

And even without a yield increase, certified seed offers a host of other tangible advantages.

Key Benefits of Certified Seed vs Farm-Saved Seed

1. Guaranteed Quality & Purity

- ADM’s certified seed is tested and verified to meet High Voluntary Standard (HVS) quality.

- It ensures varietal purity, free from weed seeds and off types.

- Farm saved seed risks contamination and a decline in genetic quality over time.

2. Superior Germination & Vigour

- Certified seed is laboratory tested for germination and vigour, ensuring even, robust establishment.

- This results in a more uniform, competitive crop right from day one.

- FSS often has variable quality.

3. Access to Improved Genetics

- Certified seed gives growers access to the latest high performing varieties with enhanced yield potential, disease resistance and grain quality.

- A lot of growers are still farm saving outdated varieties.

4. Operational Efficiency

- Certified seed removes the logistical burden of keeping seed separate, rogueing, not spraying parts of fields, or managing dressing machinery at a busy time.

- It frees up labour during peak workloads.

5. Market Advantages

- Access to market leading buyback opportunities.

When Does AN’s Premium Cease to Deliver?

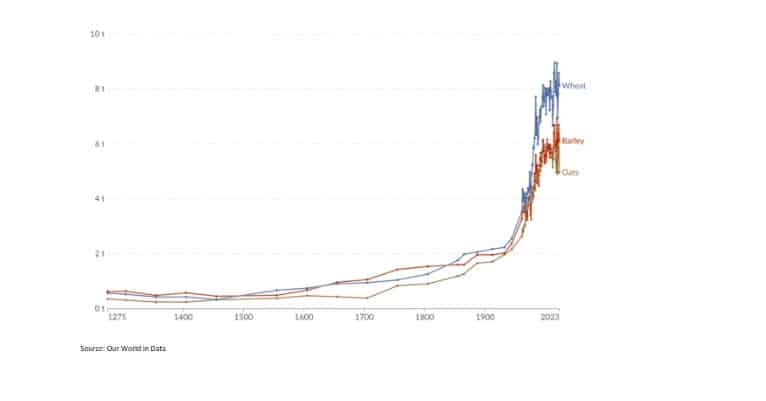

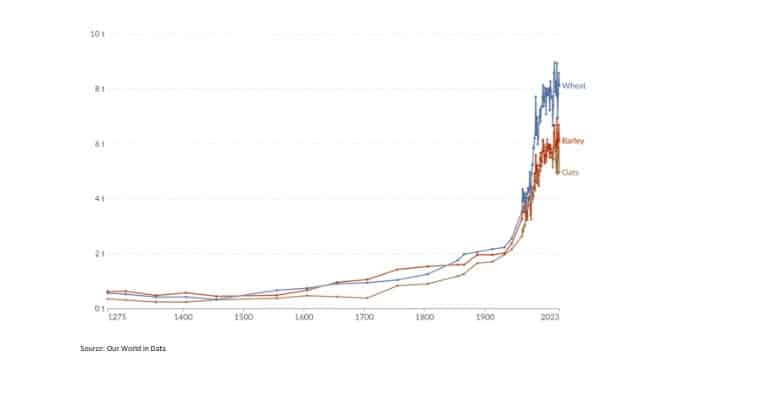

In 1988, UK fertiliser consumption exceeded 6 million tonnes; today it stands closer to 2.8–3.1 million tonnes. Over the same period, long-run averages for wheat, barley and oats have continued to trend upward. In other words: we are producing more with less.

This efficiency story has been built on decades of progress: refined fertiliser recommendations, better varieties, precision application, sulphur balancing, and more disciplined timing. Fewer tonnes of fertiliser are now supporting greater output, a significant achievement in global agriculture and a compliment to the professionalism of UK growers.

But as margins once again come under pressure, the question is where the next layer of efficiency will be found.

Long Run Cereal Yields UK

Those efficiency gains set a global benchmark, yet the challenge has shifted. Margins are under renewed pressure: grain prices remain subdued while input costs are historically volatile, with the spread between Ammonium Nitrate and Granular Urea is now a line item capable of materially influencing already stretched farm profitability.

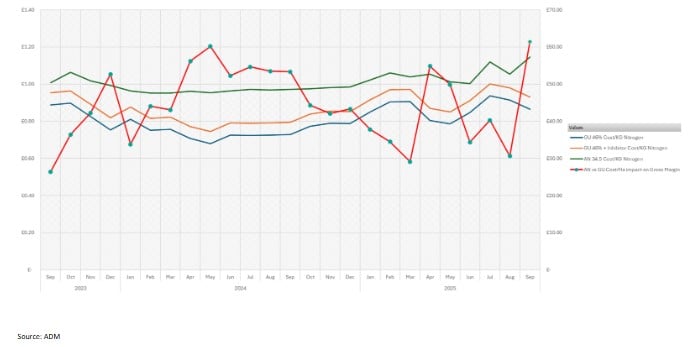

Over the last two years, the average cost advantage of Urea over AN has been around £0.20/kg-N. Today it stands nearer £0.28/kg-N. That may look like a small delta, but at typical RB209 feed wheat nitrogen rates it equates to ~£18.00/ha . Across a full programme, uninhibited Urea currently delivers more than £60/ha in saving across a whole program if the full requirement was bought today. With an inhibitor added, the benefit narrows by roughly £15/ha, but still leaves a significant margin advantage.

Granular Urea and Ammonium Nitrate Cost(£)/KG of Nitrogen

With an inhibitor added, the benefit narrows by roughly £15/ha, but crucially the perceived agronomic advantage of AN also diminishes. In practice, this leaves Urea still carrying a significant margin edge, while at the same time closing much of the performance gap growers traditionally associate with AN.

Importantly, the gap scales with nitrogen intensity. For higher-demand crops, second wheats, milling wheats, high-yielding barleys; the per-hectare saving compounds further, magnifying the financial impact across the rotation.

The question is therefore less about whether Urea is more cost-effective and more about whether today’s widening cost/kilo spread is sufficient to reconsider long-standing preferences for AN. For some, consistency, protein response or weather-risk resilience may still justify a premium. For others, the economics suggest the balance has already shifted.

The break point is not universal, but the spread is now wide enough that growers should reassess where it lies for their own system.

Commercial Flexibility from ADM

ADM can now offer Granular Urea pricing forward to May next year, providing growers with a clear cost base well into the season. Subject to approval, ADM can also provide contra arrangements and extended finance terms, giving maximum flexibility on how and when product is paid for.

For growers, this means the ability to:

- Lock in cost-per-kilo advantages today, protecting gross margin from future market swings.

- Smooth cashflow across the season, aligning input purchases with crop marketing.

- Match fertiliser commitments with grain sales, using contra to balance inflows and outflows.

In a year where every margin detail matters, the combination of forward cover, finance flexibility, and cost-per-kilo advantage allows businesses to secure not just the best price, but the freedom to deploy it on their own terms.

For more information on Granular Urea, ADM’s Granular Urea Inhibitor Piamin or Finance Terms. Contact your ADM Farm Trader or the office on 01427 421200 (Extension 6)

Summary

The AHDB harvest results provide key insights to help plan for the 2026 season, while our wheat buy-back contracts offer the security of both margin and market access. Choosing certified seed also gives crops the strongest possible start, with proven advantages in vigour and consistency to support higher yields. Alongside this, our nitrogen cost analysis helps growers optimise input spend and maximise return on investment, ensuring fertiliser strategies are both efficient and resilient against market volatility.